irs child tax credit problems

The IRS is paying 3600 total per child to parents of children up to five years of age. The IRS announced a technical issue that could affect up to 15 percent of recipients of the Child Tax Credit.

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc7 San Francisco

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

. Most families received half of the credit in advance via monthly payments last year but theres still more money to be. For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. A group of parents who received their July payment via.

WASHINGTON The Internal Revenue Service today updated its frequently asked questions FAQs FS-2022-17 PDF on the 2021 Child Tax Credit. Since July four child tax credit payments have been sent to millions of families across the US. IRS Freezes Tool for Child Tax Credit Payments.

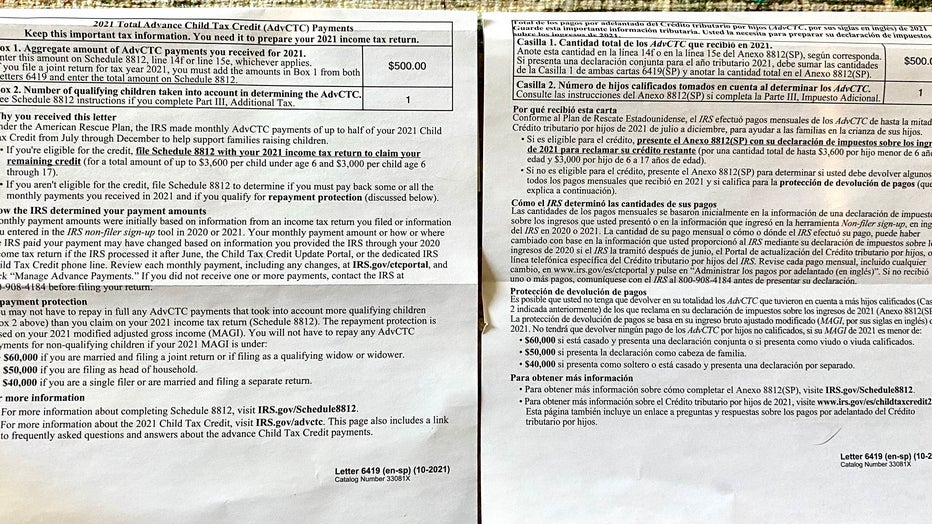

Tax Season Madness. IR-2022-53 March 8 2022. Why IRS Letter 6419 is critical to filing your 2021 taxes and the child tax credit.

IRS Admits Errors in Child Tax Credit Letters Sent to Taxpayers by Joe Bishop-Henchman January 28 2022 If you have children and received child tax credit payments in. That comes out to 300 per month and. The Internal Revenue Service says its looking into reports that some families have received inaccurate figures from the IRS about their child tax credit payments an important.

In mid-December final checks were deposited into. But if youre one of the people who experienced problems -- maybe. That drops to 3000 for each child ages six.

IR-2020-248 November 2 2020 The Internal Revenue Service today announced a number of. Find answers about advance payments of the 2021 Child Tax Credit. The expanded child tax credit for 2021 isnt over yet.

The administration has reluctantly concluded that it cannot allow them to use the portal to claim. These updated FAQs were released to the public in Fact Sheet 2022-17 PDF March 8 2022. TAdmitting that they expect another chaos-filled filing season Treasury and the IRS have been encouraging taxpayers who received advance payments of the Child Tax Credit.

However some eligible parents have reported experiencing problems with each payment. Monthly advance child tax credit payments have now ended in the US with roughly 93 billion disbursed to families in 2021. The IRS has finished sending the monthly child tax credit checks with just one more payment on the way.

How Does The Advance Child Tax Credit Work.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Flat Fee Tax Service Tax Debt Irs Taxes Tax Time

Irs Child Tax Credit Phone Number How To Get Your Questions Answered Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Advance Payments Of The Child Tax Credit I M Definitely Eligible Why Does It Says I M Not R Irs

Stimulus Checks Child Tax Credit Stimulus Check Info Available From Irs

Does That Irs Letter Bring Good News About Next Month S Child Tax Credit Payment Cnet

Advance Child Tax Credit Filing Confusion Cleared Up

First Glitch Of The Tax Season Is Here That Irs Child Tax Credit Letter May Be Inaccurate

Child Tax Credit Portal Why Is The Irs Closing Its Ctc Tool Marca

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Stimulus Update Child Tax Credit Payments To Start Hitting Bank Accounts Thursday

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Where Is My September Child Tax Credit 13newsnow Com

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money Stimulus Check Second Stimulus Check Irs

Stimulus Latest Here S What You Can Do If You Got The Wrong Child Tax Credit Amount

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet